how to take an owner's draw in quickbooks

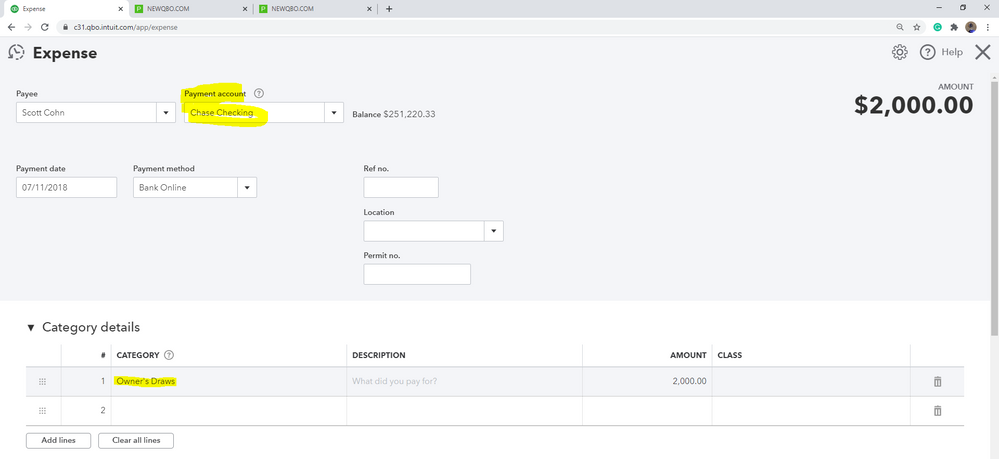

Im here to share some information about managing owners draw in QuickBooks Online. Select the Expenses tab and click the Account drop-down list.

Quickbooks Learn Support Online Qbo Support How To Set Up An Owner S Draw Account In The Chart Of Accounts

1 Create each owner or partner as a VendorSupplier.

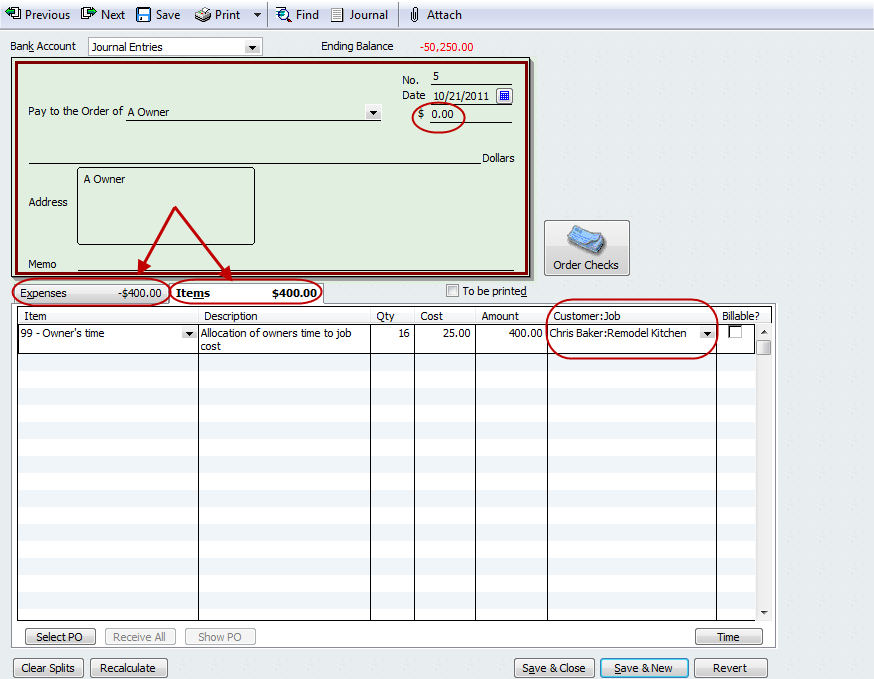

. In the Write Checks window go to the Pay to the order of section select the owner and enter an amount next to the sign. Open the QuickBooks Online application and click on the Gear sign. In the window of write the cheques you.

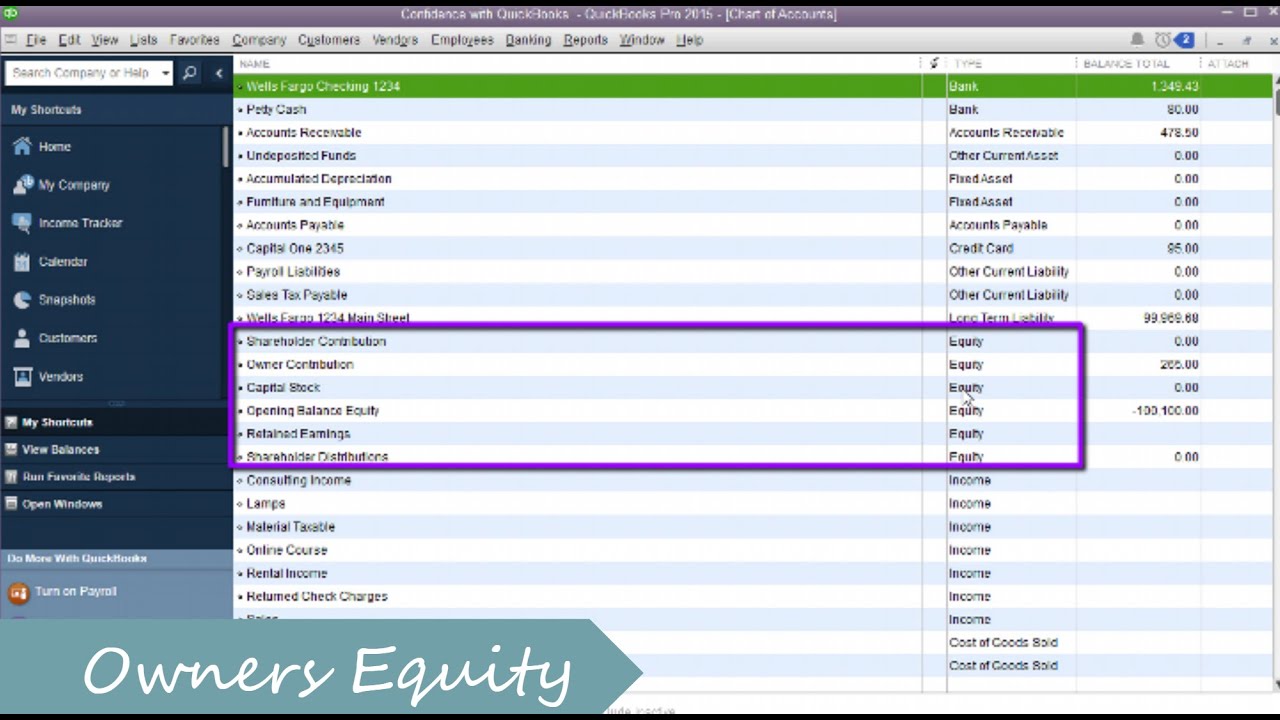

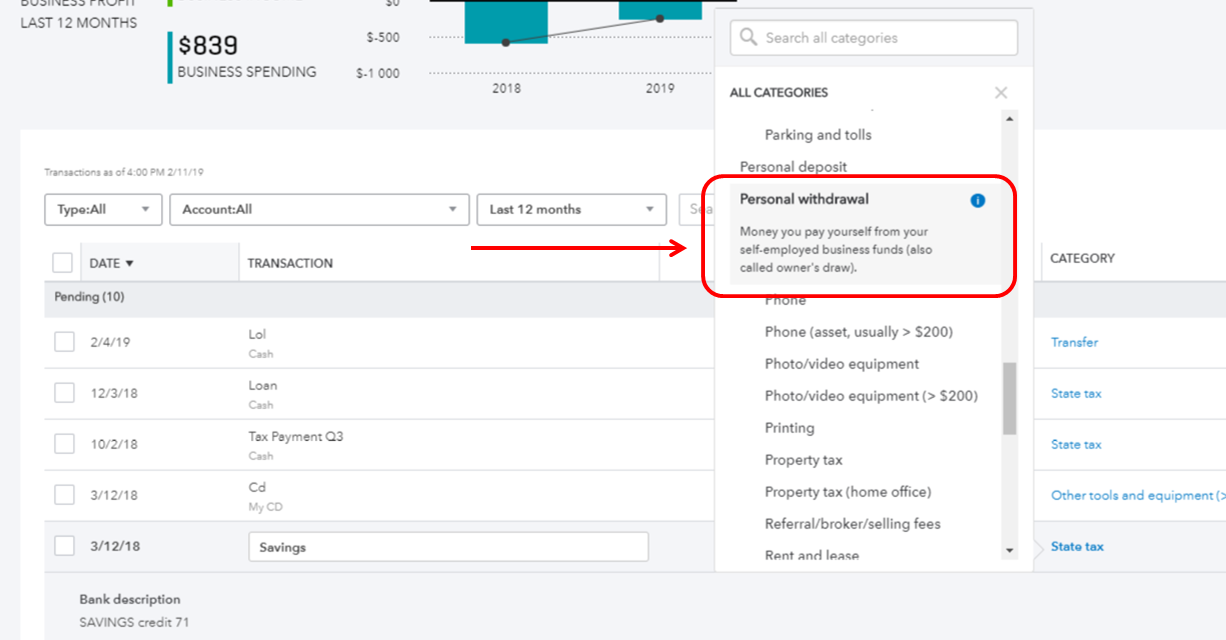

When recording an owners draw in QuickBooks Online youll need to create an equity account. A members draw also known as an owners draw or a partners draw is a quickbooks account that records the amount taken out of a company by one of its owners. Here are few steps given to set up the owners draw in QuickBooks Online.

Enter the total amount in the Amount column. Then choose the option. In the Account field be sure to select Owners equity you created.

The memo field is optional. In fact the best recommended practice is to create an owners draw. A draw lowers the owners equity in the business.

An owners draw is an amount of money an owner takes out of a business usually by writing a check. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria. An owner of a sole.

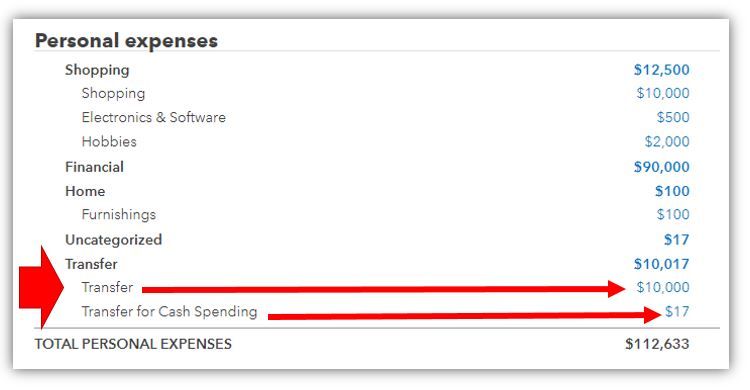

Click Save Close to record the check. Click on the Banking menu option. From an accounting standpoint owners draws are shown in the equity portion of the balance sheet as a reduction to the owners capital account.

Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner. Go to Banking and select Write Checks. Select the business account used to fund the purchase.

An owner can take up to 100 of the owners equity as a draw. The most common way to take an owners draw is by writing a check that transfers cash from your business account to your personal account. The Draw acct should be zeroed out to Owners Capital Sole Pro or Retained Earnings Corp at the end.

However the more an owner takes the fewer funds the business has to operate. Click Save Close. Report Inappropriate Content.

Setting Up an Owners Draw. Select Print later if you want to print the check. First of all login to the QuickBooks account and go to Owners draw account.

Know that you can select the equity account when creating a check for the owner. In this video we demonstrate how to set up equity accounts for a sole proprietorship in Quickbooks. Am I entering Owners Draw correctly.

This will handle and track the withdrawals of the companys assets to pay an owner. This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. To write a check from an owners equity account.

In the detail area of the check assign the amount of the check to the equity account you created to record the owners draws. To Write A Check From An Owners Draw Account the steps are as follows. Choose the bank account where your money will be withdrawn.

How much should an owners draw be. Fill in the check fields. Now hit on the Chart of.

Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each. In QuickBooks Desktop software. A clip from Mastering.

Before you can record an owners draw youll first need to set one up in your Quickbooks account. Learn how to calculate owners. We also show how to record both contributions of capita.

Click on the Banking and you need to select Write Cheques. Quickbooks bookkeeping cashmanagementIn this tutorial I am demonstrating how to do an owners draw in QuickBooks------Please watch. Visit the Lists option from the main menu.

Owner S Draw Quickbooks Tutorial

How To Record An Owner S Draw The Yarnybookkeeper

How To Record Owner S Equity Draws In Quickbooks Online Youtube

How To Record An Owner S Draw The Yarnybookkeeper

Minutes Matter In The Loop Paying Amp Reimbursing Yourself In Quickbooks Chart Of Accounts Quickbooks Accounting

How To Set Up Record Owner S Draw In Quickbooks Online And Desktop

Quickbooks Owner Draws Contributions Youtube

How To Pay Invoices Using Owner S Draw

How Do I Enter The Owner S Draw In Quickbooks Online Youtube

Solved Owner S Draw On Self Employed Qb

How To Setup And Use Owners Equity In Quickbooks Pro Youtube

Quickbooks And Owner Drawing Youtube

Owners Draw Setup Quickbooks Create Setting Up Owner S Draw Account Qb

Solved Owner S Draw On Self Employed Qb

How Do I Enter The Owner S Draw In Quickbooks Online Youtube

How Do You Set Up An Owners Draw Without Using Che

How To Pay Invoices Using Owner S Draw

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc