city of mobile al sales tax application

Montgomery County AL Sales Tax Rate. This is the total of state county and city sales tax rates.

York Adams Tax Bureau Pennsylvania Municipal Taxes

Sales Tax Application Consumer Use Tax Registration Free viewers are required for some of the attached documents.

. To pay Mobile County School SalesUse Tax due in the ordinary course of business see section MOBILE COUNTY 7049 details above. SALES TAX ALCOH. Application for Sales Tax Certificate of Exemption An Alabama Sales Tax Certificate of Exemption shall be used by persons firms or corporations coming under the provi-sions of the Alabama Sales Tax Act who are not required to have a Sales Tax License.

While alabamas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Please note however that the monthly discount may not exceed 40000. In mobile or our downtown mobile office at 151 government st.

Contact Directory Revenue Director Donna Bryars 251 208-7462 Revenue Manager Cyndi Sims. Forms Mobile County Revenue Commission Forms Please print out the forms complete and mail them to. Wayfair Inc affect Alabama.

Columbiana additional 4 sales tax on the retail sale of any liquor or alcoholic beverages excepting beer sold for on or off premises consumption. We continue to provide satellite offices in downtown Mobile Theodore Eight Mile and Citronelle to aid taxpayers in all of Mobile County. Application Authorization Certificate of Good Standing Request Corporate Officer Change Itinerant Vendor Application Lodging Tax Return Petition for Refund Power of Attorney Special Events Tax Preliminary Assessment Review Mobile County Sales Tax Form.

City Ordinance 34-033 passed by the City Council on June 24 2003 went into effect October 1 2003. Rate per 1000 assessed valuation within City of Mobile City of Mobile 700. They can be downloaded by clicking on the icons below.

Acrobat Reader Windows Media Player Word Viewer Excel Viewer PowerPoint Viewer Contact License Revenue Division 25 Washington Avenue 3rd Floor Montgomery AL 36104. In mobile or our downtown mobile office at 151 government st. Mobile AL 36652-3065 Office.

For a copy of our application for a tax account or business license click here. However non-state administered local taxes that may be filed through MATONE SPOT may have a different discount rate and MAT has been programmed accordingly. 8 AM - 4 PM Kay A Hart-Tobacco Tax Collector Clarence Berg - Tobacco Tax Accountant Susan Dover- Office Assistant II.

Alabama Legislative Act 2010-268. The sales tax discount consists of 5 on the first 100 of tax due and 2 of all tax over 100. In Mobile Downtown office is open on Monday and Friday only.

Apply for a Mobile County Tax Account at our Michael Square Office at 3925-F Michael Blvd. 2519283002 2519435061 2519379561 fax 2519726836. Please call the Sales Tax Department at 251-574-4800 for additional information.

The sales tax discount consists of 5 on the first 100 of tax due and 2 of all tax over 100 not to exceed 40000. Alabama Legislative Act 2010-268 now mandates that customers using a Visa or Mastercard will be charged a 23 fee 150 minimum for each registration year renewed as well as 100 mail fee for decals. Box 1169 Mobile AL 36633-1169 Board of Equalization-Appeals Form Business Personal Property andor Personal Aircraft Return Application for Current Use Valuation for Class 3 Property Return.

The Alabama sales tax rate is currently. Sales Tax If you are unable to fill out these forms please install Adobe Acrobat Reader here. In Mobile or our Downtown Mobile office at 151 Government St.

Sales Tax Form 12 PDF FILE Seller Use Tax Tax Form 13 PDF FILE Business License Application PDF FILE City of Mobile Alcoholic Beverage Application PDF FILE City of Mobile. Our main office is located at 3925 Michael Square Suite G on the corner of Michael Boulevard and Azalea Road. Section 34-22 Provisions of state sales tax statutes applicable to article states.

800 to 300 monday tuesday thursday and fridays and 800 to 100 wednesdays. A homestead exemption may be available to citizens who use their property exclusively as their home. Revenue Department The Revenue Department administers the Privilege License Tax Ordinances of the City of Mobile which involves collection of monthly Sales Use Taxes and licensing businessesprofessions doing business within the Mobile License Tax Jurisdiction.

The maximum amount of the exemption is 4000 for state taxes and 2000 for county. We also processes the monthly Mobile County SalesUseLease Tax. The 2018 United States Supreme Court decision in South Dakota v.

The Mobile sales tax rate is. The County sales tax rate is. Did South Dakota v.

You may also apply by phone or fax. Childersburg tax rates for rentals made and lodgings provided within the corporate limits and police jurisdiction of the city. 800 to 300 Monday Tuesday Thursday and Fridays and.

This office is centrally located and offers ample free parking and handicap access. Combined Application for SalesUse Tax Form On-Line Sales Tax SalesSellers UseConsumers Use Tax Form Motor FuelGasolineOther Fuel Tax Form Lodging Tax Form Rental Tax Form Power of Attorney Power of Attorney Taxpayer Bill of Rights If you need information for tax rates or returns prior to 712003 please contact our office. The minimum combined 2022 sales tax rate for Mobile Alabama is.

Sales tax form 12 pdf file seller use tax tax form 13 pdf file business license application pdf file city of mobile alcoholic beverage application pdf file city of mobile business license overview external link. 1150 Government Street Room 112 Mobile AL 36604 251-574-8580 251-574-8599 FAX TobaccoTaxmobilecountyalgov Hours. The Revenue Department administers the Privilege License Tax Ordinances of the City of Mobile which Involves the collection of monthly Sales Use Taxes and licensing businessesprofessions doing business within the Mobile License Tax Jurisdiction.

Declaration of US Citizenship Letter - Form A Declaration of US Citizenship Letter - Form B Direct Petition for Refund Food Beverage Tax Form 7 Joint Petition for Refund Leasing Tax Form 3 Petition for Release of Penalty Sales Tax Form 12 Seller Use Tax Tax Form 13 Business License Application City of Mobile Alcoholic Beverage Application. 2 Choose Tax Type and Rate Type that correspond to. The sales tax discount consists of 5 on the first 100 of tax due and 2 of all tax over 100 not to exceed 40000.

Revenue Department 205 Govt St S. City of Mobile Alcoholic Beverage Application Business License Application Seller Use Tax Tax Form 13 Sales Tax Form 12 Petition for Release of Penalty Leasing Tax Form 3 Joint Petition for Refund Food Beverage Tax Form 7 Direct Petition for Refund Declaration of US Citizenship Letter - Form B Declaration of US Citizenship Letter - Form A. Montevallo AL Sales Tax Rate.

Sales and Use taxes have replaced the decades old Gross Receipts tax. A mail fee of 250 will apply for customers receiving new metal plates.

The World S First Digital Wellness Certificate Program For Leaders And Practitioners Addressing The Social Media Di Data Science Marketing Trends Future Trends

How Do State And Local Sales Taxes Work Tax Policy Center

Mobile Food Vendor City Of Fort Worth Texas Consumer Health Health Reviews

How Do State And Local Sales Taxes Work Tax Policy Center

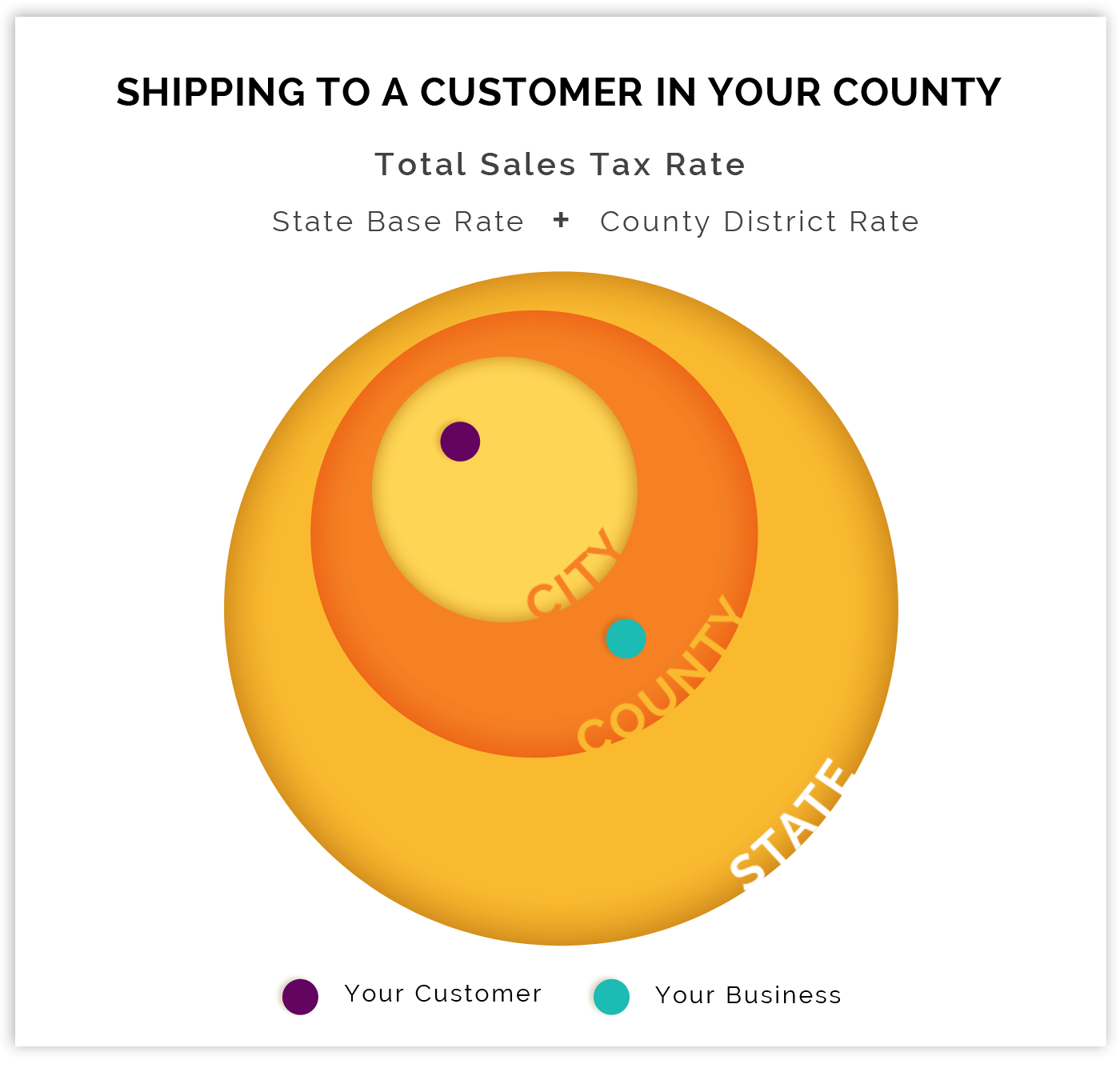

Taxes City Of Aiken Sc Government

Chicago Now Home To The Nation S Highest Sales Tax Sales Tax Tax Chicago

Licenses And Taxes City Of Mobile

Arizona Sales Tax Small Business Guide Truic

Bald Barista Dublin Barista Coffee Art Dublin

Woolworth Register Receipt From 9 28 1996 Store 2280 Blue Ridge Mall Kansas City Mo Kansas City Blue Ridge Kansas

Arizona Sales Tax Small Business Guide Truic

Real Estate And Personal Property Tax Unified Government Of Wyandotte County And Kansas City

Uae There Are No Plans To Introduce Income Tax In 2022 Income Tax How To Plan Income

Business Sales Use Tax License Littleton Co

Free Bill Of Landing Template Sample Bill Of Lading Bills Business Template